… We’ve capacity to meet ECOWAS’s petroleum needs ―Dangote

Towering over the Lekki Free Zone on the edge of the Atlantic, the Dangote Petroleum Refinery is more than just a feat of engineering; it has become a symbol of ambition, vision, and industrial self-reliance for an entire continent. Now, that promise has been affirmed by the region’s highest political and economic bloc, the Economic Community of West African States (ECOWAS).

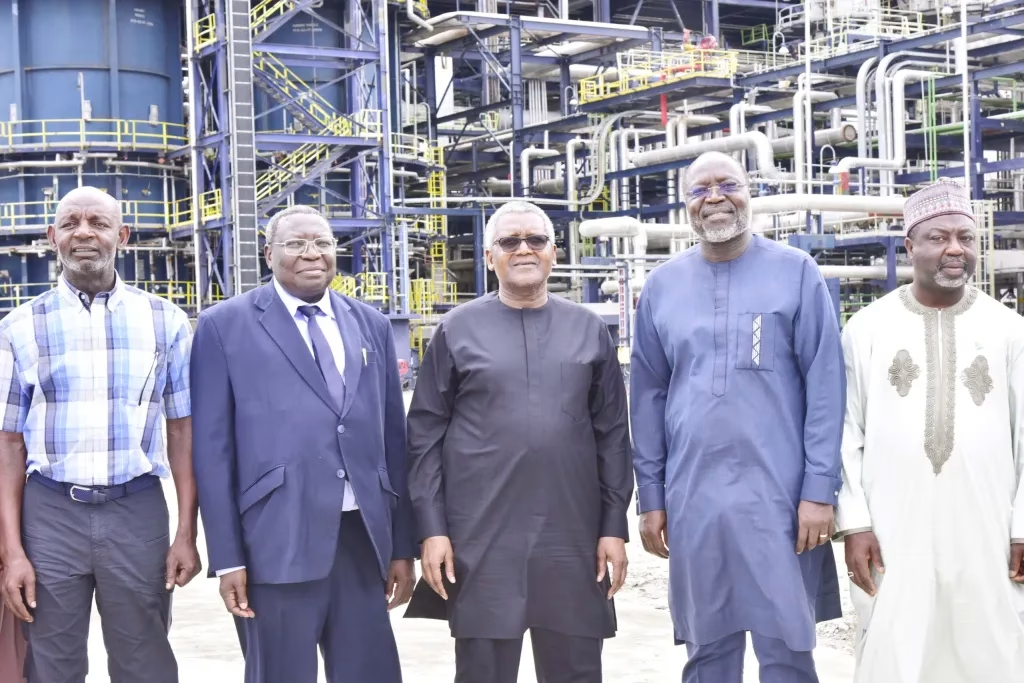

During a high-level visit to the state-of-the-art 650,000 barrels-per-day facility, the President of the ECOWAS Commission, H.E. Dr Omar Alieu Touray, declared the refinery a beacon of hope for Africa’s future, and a clear demonstration of what the private sector can achieve in the drive for regional industrialisation. The delegation also included ECOWAS Commissioner for Infrastructure, Energy and Digitalisation, Sediko Douka; Commissioner of Internal Services, Prof. Nazifi Abdullahi Darma; Director of Private Sector/SME, Dr Tony Luka Elumelu; and Dr Touray’s Chief of Staff, Hon Abdou Kolley, among others.

“What I have seen today gives me a lot of hope, and everybody who doesn’t believe in Africa should come here. Visiting here will give you more hope because this is exactly what our continent should focus on,” Dr Touray remarked, visibly moved by the scale and sophistication of the facility. “We have seen something I couldn’t have imagined, and really the capacity in all areas is impressive. We congratulate Alhaji Dangote for this trust in Africa because I think you do this only when you have the trust, and he has a vision for Africa, and this is what we should all work to encourage.”

Dr Touray noted that the refinery, which produces fuel to Euro V standard, is critical for enabling the ECOWAS region to meet its 50ppm sulphur limit for petroleum products—a standard many imported fuels fail to meet, posing health and environmental risks across member states.

“We are still importing products below our standard when a regional company such as Dangote can meet and exceed these requirements,” he said. “The private sector must take the lead in ECOWAS industrialisation.”

The ECOWAS Commission President used the visit to call for stronger collaboration between governments and the private sector, stressing that policy decisions must reflect the real challenges and opportunities experienced by African industrialists.

“We believe our visit also serves as an opportunity to hear directly from Mr Dangote, about what the private sector expects from the ECOWAS community,” Dr Touray remarked, noting that as ECOWAS celebrates its 50th anniversary, the community is more committed than ever to bringing the private sector to the table—to listen to their perspectives and to understand how best to create an environment that works for them.

“We cannot continue to make decisions on behalf of the private sector from a distance. Visits like this provide us with first-hand experience and direct insight into the challenges they face—challenges that authorities and government officials must work to address,” he added.

Dr Touray said the time is ripe for the region to pursue an industrial strategy capable of addressing deep-rooted challenges such as youth unemployment, poverty, and insecurity.

“We often speak about poverty eradication and youth employment, but the government alone may not have the capacity to achieve these goals. Only the private sector can deliver the scale of impact required, and it is essential that we listen to them, understand how these objectives can be met, and identify the bottlenecks they face so that they can be effectively addressed. This is the only realistic path to creating jobs and fostering genuine prosperity across our economies.”

He pledged the Commission’s full support for enabling regional giants such as Dangote Group to access wider ECOWAS markets and urged other African nations to follow Nigeria’s example by building infrastructure that serves the continent, not just individual countries.

“Once again, I congratulate the Dangote Group and commit that ECOWAS Commission will do everything to open up the ECOWAS market for them, if not the entire African continent.”

President of Dangote Group, Aliko Dangote, led the ECOWAS delegation on a detailed tour of the facility, explaining the challenges and milestones involved in bringing the world’s largest single-train refinery to life.

He reiterated his longstanding position that Africa’s continued dependence on imported goods is unsustainable and hinders economic sovereignty.

“As long as we continue importing what we can produce, we will remain underdeveloped,” Dangote said. “This refinery is proof that we can build for ourselves at scale, to global standards.”

He noted that the Dangote Refinery is fully equipped to meet the petroleum needs of Nigeria and the entire West African region, countering claims that the facility would not produce enough for local and regional demand.

“There have been many claims suggesting that we don’t even produce enough to meet Nigeria’s needs, so how could we possibly supply other West African countries? But now, they are here to see the reality for themselves and, more importantly, to encourage other nations to embark on similarly large-scale industrial projects,” he said.

Noting that Africa will benefit greatly by encouraging trade among its countries, especially through value addition to the continent’s abundant resources, Dangote stressed how the refinery has helped Nigeria to bring down the cost of refined products and production costs across many sectors of the economy.

“Last year, when we began diesel production, we were able to reduce the price from N1,700 to N1,100 at a go, and as of today, the price has crashed further. This reduction has made a significant impact across various sectors. It has supported industries, benefited those of us in mining, and provided vital relief to the agricultural sector. The effect has been far-reaching,” he said.

He also noted that Nigerians are benefiting from local refining as the price of petrol has dropped significantly compared to neighbouring countries.

“In neighbouring countries, the average price of petrol is around $1 per litre, which is N1,600. But here at our refinery, we’re selling at between N815 and N820. Many Nigerians don’t realise that they are currently paying just 55% of what others in the region are paying for petrol. We also have a much larger initiative in the pipeline, something we’ve not yet announced but Nigerians should know that this refinery is built for them, and they will enjoy the maximum benefit from it,” he said.

He emphasised that this price reduction is a direct result of local refining, which continues to improve fuel affordability while enhancing energy security and reducing dependence on imports.