By Our reporters

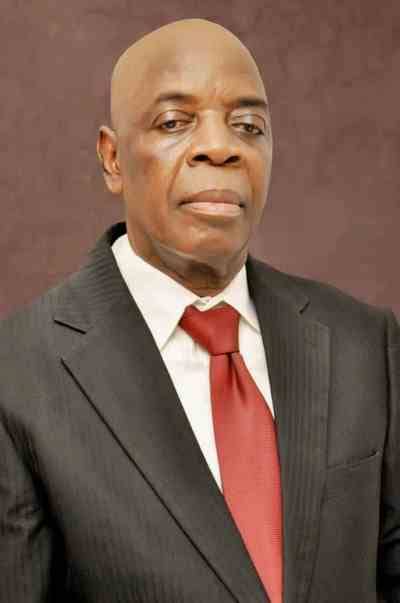

The Chairman of the Board of Directors, NPF Microfinance Bank, Otunba Samuel Damilola Adegbuyi, stated that the bank’s commitment to financial inclusion has helped bridge gaps, foster economic growth, and create a more inclusive financial ecosystem.

Otunba Adegbuyi disclosed this during a stakeholders’ interactive forum organized by NPF Microfinance Bank, held at the Officers’ Mess, Ikeja, Lagos, on Monday.

Speaking at the interactive forum, Otunba Adegbuyi said: “In 2023, NPF Microfinance Bank Plc made significant strides in promoting financial inclusion. We expanded our reach to underserved communities, providing essential financial services to over 680,730 new customers. Through innovative solutions and strategic partnerships, we were able to offer affordable and accessible financial products, empowering individuals and small businesses to achieve their financial goals. Our commitment to financial inclusion has helped bridge gaps, foster economic growth, and create a more inclusive financial ecosystem. We are proud of our achievements and remain dedicated to continuing this important work.”

Explaining further, Adegbuyi added, “In spite of the challenging economic environment in which the bank operated, our performance improved remarkably over 2022. NPF Microfinance Bank is committed to delivering returns to our shareholders as the bank believes in balancing returns on investment with support for future growth and survival.”

The Managing Director of NPF Microfinance Bank, Habeeb Yusuf, stated: “Our continuous adherence to financial reporting standards has ensured transparency and accuracy in our financial disclosures, reinforcing stakeholder trust. We shall continue to uphold these standards. We have made significant strides in enhancing business operations through process improvements on loans with technologies, leading to better service delivery and operational excellence. Our digital banking platforms have become more stable and efficient.”

Appreciating shareholders and stakeholders for their support and patronage, Yusuf stated: “Your firm support and trust are the foundation of our success. We will continue to pursue technological advancements and digital capabilities while staying true to our values of integrity. This will guide our transformation into a platform that enables economic growth and creates value for our customers and shareholders.”

Speaking on diversity and inclusion, the company secretary/legal adviser, Osaro Idemudia, said: “At NPF Microfinance Bank, we understand that for us to thrive and achieve our vision to be the clear leader in the provision of microfinance services, we must build a diverse and inclusive workforce that reflects the totality of our customer base. The bank operates a non-discriminatory policy in the consideration of applications for employment. The bank seeks to achieve an appropriate mixture of female representation at the top management level. Though this is yet to be achieved on the board as indicated below, we are currently working to ensure more female representation on the board.”